does california have an estate tax in 2021

Ad Get Access to the Largest Online Library of Legal Forms for Any State. This is often a surprise to.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

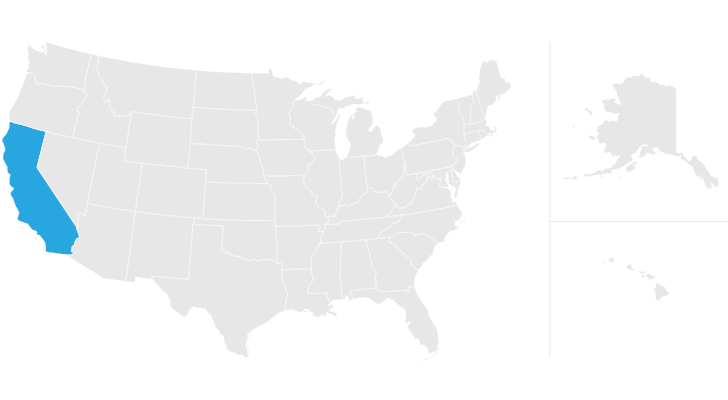

California does not have an estate tax or an inheritance tax.

. Proposed California Estate Tax for 2020 Did Not Make Ballot. Again as noted it is still important to put in place an estate plan so that your estate avoids probate. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

Ad Properly drafted estate plan does more than merely specifying what happens to your assets. Ad Properly drafted estate plan does more than merely specifying what happens to your assets. As of 2021 the deceased individuals estate is subject to the estate tax when their taxable estate exceeds 11700000.

2022 Federal Estate Tax Threshold Explained. This amount is known as the estate tax exemption as any. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains.

In 2022 Connecticut estate taxes will range from 116 to 12. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Does California Impose an Inheritance Tax.

As of 2021 12 states plus the District of Columbia impose an estate tax. California does not have an estate tax. The estate tax exemption reduced by certain lifetime gifts also increased to 11700000 in 2021.

In fact few states do as of 2021 only 12 states and the District of Columbia impose an estate tax. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. The tax rate on gifts in excess of 11700000 remains at 40.

Without planning your best intents to properly distribute your estate might not be enough. If an estate is worth more than 1206 million dollars for single individuals and 2412 million dollars for married couples in. Without planning your best intents to properly distribute your estate might not be enough.

California does not have an inheritance tax or a death tax in 2021. 2022 Estate Tax Exemption Increased to 1206 Million for Individuals 2412. California estate tax.

However California is not among them. The Economic Growth and Tax Relief. People often use the terms estate.

Home Business Tax Deductions Keep What You Earn In 2022 Business Tax Business Tax Deductions Tax Deductions

California Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

25919 Dark Creek Rd Calabasas Ca 91302 Mls 19432772 Zillow Calabasas Estate Homes Dream Properties

Estate Of The Day 9 9 Million Mediterranean Mansion In Rancho Santa Fe California Mediterranean Mansion Mansions Mansions Luxury

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Here Are The U S States With No Income Tax The Motley Fool Income Tax States In America Income

1910 Loma Vista Dr Beverly Hills Ca 4 Beds 5 Baths

States With No Estate Tax Or Inheritance Tax Plan Where You Die

604 Lake Sherwood Dr Lake Sherwood Ca 91361 5 Beds 5 Baths

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

707 Park Ln Santa Barbara Ca 93108 Photo 1 Of 30 Santa Barbara Style Homes Santa Barbara House Spanish Style Homes

Pin By Terry Wilson On Wilson Inheritance In 2022 Revocable Living Trust Estate Planning Living Trust

California Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Estate Tax Everything You Need To Know Smartasset

California Estate Tax Everything You Need To Know Smartasset

Zestimate Home Value 29 891 766 Spectacular Grand Estate At The End Of A Long Private Gated Driveway Paisajismo De Entrada Camino De Entrada Casas Grandes

Is Inheritance Taxable In California Law Offices Of Daniel Hunt